Save smarter! Reach your goals faster

Open your savings account today and start growing your money!

How to get started

Savings tiers & earnings

| Daily balance (SAR) | Annual equivalent rate | Profit sharing rate |

| Less than 1,000 | 0% | 0% |

| 1,000 – 9,999.99 | 1.9% / Year | 50% |

| 10,000 – 24,999.99 | 2.28% / Year | 60% |

| 25,000 – 99,999.99 | 2.76% / Year | 72.5% |

| 100,000 – 249,999.99 | 3.23% / Year | 85% |

| 250,000 and above | 3.61% / Year | 95% |

**The Annual Equivalent Rate (AER) shows the profit you’d earn if paid over a full year. Actual rates may vary depending on the time period and are subject to change. If rates are updated, you’ll find the latest information here on our website.

FAQs

-

What is the Smart Saver Account?

The Smart Saver Account is a Shariah-compliant savings solution that helps you save and grow your money effortlessly. It offers features like Round-Up Savings and Auto-Save, along with competitive profit-sharing

-

How is the Smart Saver Account different from the current account?

Unlike the current account, the Smart Saver Account earns you profits on balances above 1000 SAR, allowing your money to grow over time. It also comes with innovative features to help you save more efficiently.

-

Is the Smart Saver Account Shariah-compliant?

Yes, the account operates under the principles of Mudarabah, where profits are shared between the customer and the bank based on a pre-agreed ratio.

-

How does the Save Smart Account follow the Islamic profit and loss sharing mechanism?

The Save Smart Account is based on the Mudarabah principle, a Shariah-compliant partnership where: • Customer (Rabb-ul-Mal): Provides funds for investment. • Bank (Mudarib): Manages and invests the funds in approved Sharia-compliant ventures. Profits are shared between the customer and the bank based on a pre-agreed ratio (e.g., 70:30 for certain balances).

-

How are profits calculated on my Smart Saver Account?

Profits are calculated daily based on your balance and credited to your account on the 1st day of the following month. Only balances above 1000 SAR are eligible for the profit calculation.

-

What happens if my balance falls below 1000 SAR?

If your balance drops below 1000 SAR during the month, you won’t earn profits for the days your balance remains below this threshold. You’ll be notified so you can add funds to maintain eligibility.

-

When will I receive my profits?

Profits are credited to your account on the 1st day of every month for the previous month’s earnings.

-

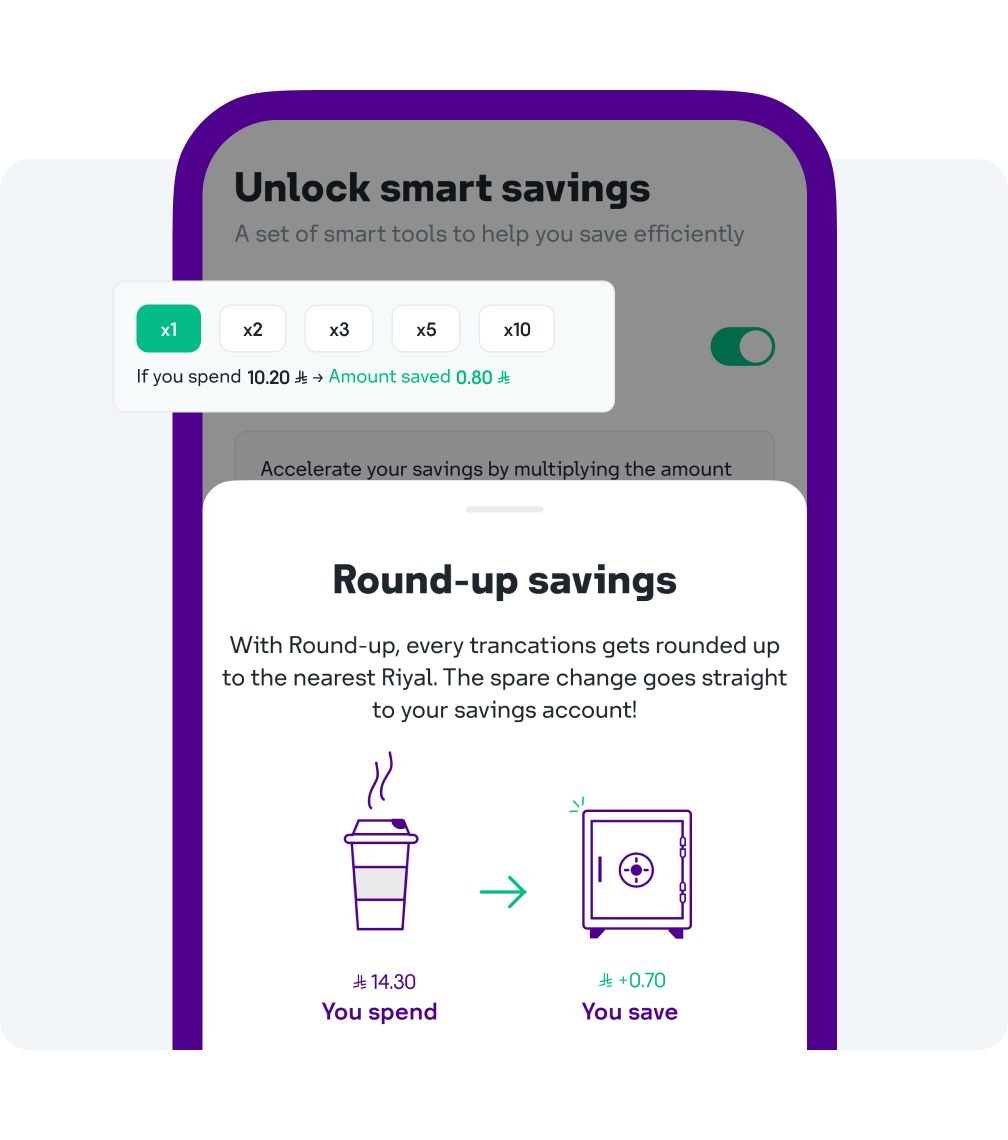

What is Round-Up Savings?

Round-Up Savings automatically rounds up every transaction to the nearest SAR (or your chosen increment, e.g., 1 SAR, 5 SAR ) and transfers the difference to your savings account. This helps you save effortlessly with every purchase.

-

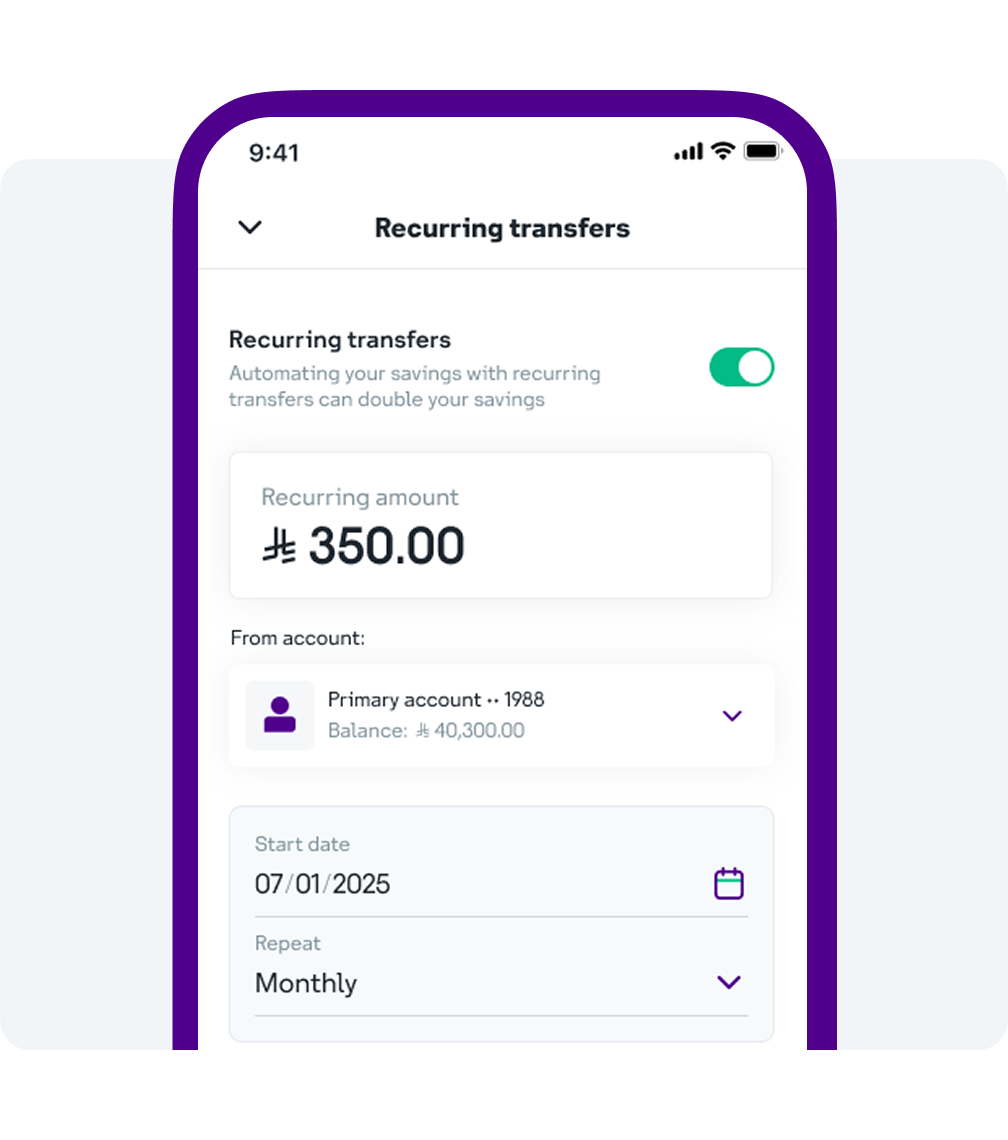

Can I customize my Smart Saver features?

Yes, you can personalize features like Round-Up increments and Recurring transfers. These settings can be adjusted anytime through the app.

-

Can I withdraw money from my Smart Saver Account?

Yes, you can withdraw funds at any time. However, withdrawals that reduce your balance below 1000 SAR may impact your profit eligibility for that month.

-

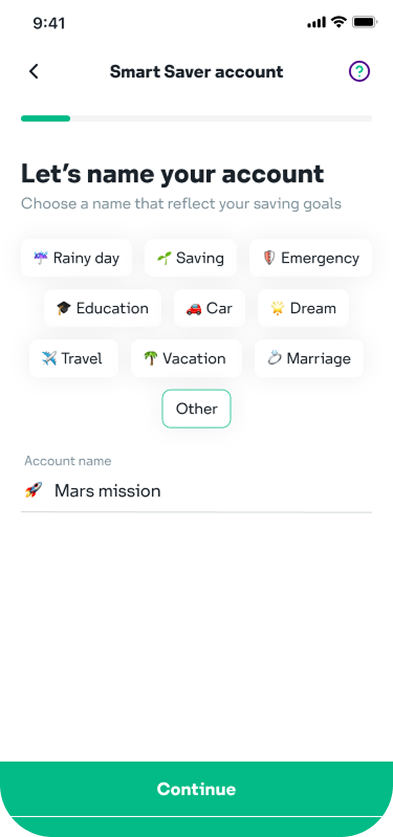

Can I rename my savings account?

Absolutely! You can personalize your account name (e.g., "Vacation Fund" or "Emergency Savings") in the app to align with your financial goals.

-

How can I access my account statements?

You can view and download detailed monthly account statements, including profit earnings and transactions, directly from the app.

-

How do I open a Smart Saver Account?

You can open a Smart Saver Account instantly through the STC Bank app. Simply log in, select "Smart Saver Account," and follow the enrollment steps.

-

What if I have further questions or need help?

If you have any additional questions or need assistance, you can contact our customer support team via the app.